O’Connor was Able to Reduce Fort Bend Taxable Value by $931 Million 2025

O’Connor discusses how our team was able to reduce the Fort Bend taxable value by $931 million 2025.

SUGAR LAND , TX, UNITED STATES, November 17, 2025 /EINPresswire.com/ --Fort Bend County has historically been the most protested county in Texas. Long before trendy spots like Travis, Denton, and Collin counties began setting records, Fort Bend was facing off against the aggressive Fort Bend Central Appraisal District (FBCAD). Until only a few years ago, Fort Bend County had the highest property taxes in the Lone Star State, which is already infamous for how much business and homeowners pay each year. This constant battle has left the taxpayers of the county with a serious chip on their shoulders, and they routinely get the better of FBCAD every year.

We at O’Connor have been staunch allies of the people of Fort Bend County for the past 50 years and have often partnered with taxpayers across the area in their battle against some of the most outrageous taxes ever seen in Texas. On average, taxpayers that chose O’Connor were able to save more money than those that took a different path. In this article, we will see how effective property taxes were and how we at O’Connor were able to improve upon county reductions. We do not wish to downplay just how effective appeals were for taxpayers across the county, and we wish to encourage all the people of Fort Bend to exercise their right to protest, even if it is not with us. The people of Fort Bend County have always been resilient in the face of taxation and all taxpayers across Texas should hold them up as examples.

Homeowners That Used O’Connor Saved Double on Their Taxable Value

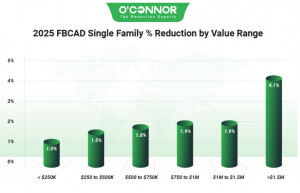

Fort Bend County has the reputation as the most exclusive suburb of Houston and 2025 certainly bore that out. Initially, FBCAD assessed the fair market value of all homes was $126.70 billion. Thanks to a bevy of appeals by homeowners, this was eventually reduced by 1.7% to $124.53 billion. Most of this value was generated by homes worth between $250,000 and $500,000, which accounted for $57.25 billion. This was eventually cut down by 1.5%, the largest cut among all categories. Homes in the price range of $500,000 to $750,000 were in second place with $35.48 billion, before a reduction of 1.8%. The third place category was homes worth between $750,000 and $1 million, which saw a drop of 1.9%. Those that chose O’Connor generally saw a massive improvement and were able to reduce their taxable value total by 3.6%, which easily eclipsed the county number of 1.7%. Our clients saved over $584.29 million in taxable value.

Despite an unearned reputation as an enclave of McMansions, most homes in Fort Bend County were of modest sizes. $80.22 billion in value came from homes that ranged between 2,000 and 3,999 square feet, before being knocked down 1.7% to $78.89 billion. After a decrease of 1.2%, homes under 2,000 square feet accounted for $20.03 billion, while those between 4,000 and 5,999 square feet reached $21.74 billion after a cut of 1.9%. The two largest reductions came, oddly enough, from the two largest home categories. Those that ranged from 6,000 to 7,999 square feet accomplished a drop of 2.7%, while those over 8,000 square feet experienced a decrease of 6.1%. These combined for $2.38 billion and $1.48 billion respectively.

While all Houston suburbs, and the city itself, experienced a giant housing boom in the early 2000s, Fort Bend County was the true standout. 58.9% of all residential property value was built between 2000 and 2020, which equated to $74.55 billion. This huge block of real estate managed to see a 1.6% drop thanks to consistent appeals. Those built between 1981 and 2000 were in second place with $27.62 billion after receiving a decrease of 1.5%. New construction is already a huge factor in the county and was already responsible for 11% of all home value in 2025. After being cut down 3.1%, these homes combined for $14.41 billion. Undeveloped land or homes under construction were counted as “other” and still managed a reduction of 1.7%. The two oldest categories of homes only accounted for a combined 7.2% of all value.

Business Owners Saved 21% on Their Property Values Thanks to O’Connor

While Fort Bend has long been known as a suburban and exurban stronghold, commercial properties ae becoming a hot commodity and the business community has reached heights never seen before. All forms of businesses combined for a worth of $22.73 billion in 2025. Thanks to dedicated protestors, this was quickly shaved by 10.3%, to $20.26 billion. $14.40 billion came from properties worth over $1.5 million, which is the usual pattern for businesses in Texas. These were eventually decreased by 14.8% to a new total of $12.27 billion. Those worth between $1 million and $1.5 million were in second place with $5.09 billion after a reduction of 5.2%. Business owners that partnered with O’Connor saw some huge dividends, and the total taxable value of their properties was slashed 21.1%. Those worth over $1 million received a cut of 25.7%. In total, our clients knocked off $346.70 million of their total tax burden.

Except for very few circumstances, apartments are usually the No. 1 commercial property in Texas counties. Fort Bend was one of those rulebreakers, as the top source of value for business properties was actually raw land. This illustrates the value of property in general in the county and that new development is on the horizon. Raw land was valued at $7.18 billion, though a slew of appeals shaved it by 4.2% to $6.88 billion. Apartments did well, as usual, and were responsible for $5.66 billion before a reduction of 13.5%. Retail was a surprising third with $3.57 billion in value after a huge slice of 16%. Offices likewise saw a huge reduction of 15.2%. Hotels, the smallest category, were also the fastest growing in the county. This spike in taxable value was stymied by an enormous reduction of22%, bringing the total to $381.46 million.

Just like homes, most of Fort Bend County’s commercial property value was built between 2001 and 2020, with over 41.5% of it coming from this timeframe alone. After an astounding appeal campaign in 2025, taxpayers reduced this timeframe’s value by 12.7%, leaving a total of $8.41 billion. The second-largest category was “other,” referring to raw and undeveloped land, which was responsible for 34% of all property value. This got a modest cut of 4.2%, but that could still lead to substantial savings. The last two major contributors were those constructed from 1981 to 2000 and new construction. Properties from 1981 to 2000 generated $2.95 billion in value, after a cut of 17.7%. New construction accounted for $1.5 billion after a reduction of 9.3%.

O’Connor Saved Apartment Owners Over $86 Million in Value

Apartments are the second-most valuable commercial properties in Fort Bend, only behind raw land. This is an aberration in Texas, as multifamily homes are usually No. 1. These were still a big factor as a whole, with $6.65 billion in combined value in 2025, before taxpayers managed to land a solid reduction of 13.5%. The boom period’s effects are even more apparent, with 74.6% of all value being built between 2001 and 2020. This massive category was cut down 12.8%, providing relief to owners and renters. Those built from 1981 to 2000 were in a distant second place and managed a reduction of 15%. New construction was in the third spot with $268.78 million, before being reduced by 10.8%. Apartment owners represented by O’Connor saw an overall value cut of 20.3%, while apartments built between 2001 and 2020 were cut 17.5%. Our clients saved around $86.20 million on their taxable value.

For assessment purposes, FBCAD divides apartments into three categories. The largest is generic apartments, which accounted for $4.81 billion after getting a reduction of 13.3%. The smallest subtype was high-rise apartments, which contributed $20.85 million after a huge cut of 22%. Garden apartments were in the middle, with a total of $63.51 million, which was the result of a huge slashing of 23.6%. O’Connor represented every single owner of garden apartments in Fort Bend County, which brought owners a savings bonanza of $19.63 million in value.

Due to its suburban roots, Fort Bend County has relatively little when it comes to offices, though that trend is quickly changing. After a solid decrease of 15.2%, the total value of offices was $2.51 billion. When it comes to timeframes of construction, the established trend continued, with over 51.3% of all value coming from offices built between 2001 and 2020. These offices combined for $1.30 billion after a decrease of 13.5% thanks to appeals. Those built from 1981 to 2000 were in second place with $604.92 million after a huge reduction of 23.6%. New construction was again in the No.3 spot, totaling $484.43 million after nabbing a cut of 7.1%. Office owners that partnered with O’Connor got a higher overall reduction of 18.3% to their total. This translated into a savings of around $68.35 million in value.

Like apartments, offices are broken down into three categories by FBCAD. Low-rise buildings were the largest of them, with a total of $1.64 billion after a large reduction of 16.4%. Medical offices were in second place with $814.37 million after a beefy decrease of 13.5%. Again, like apartments, high-rise buildings were rare but still contributed $56.34 million after a small cut of 1.8%.

Retail Properties Reduce Value by Nearly 26% with O’Connor

After a strong reduction of 16% thanks to diligent taxpayer appeals, retail spaces in Fort Bend combined for $3.57 billion in total taxable value. Like all other properties we have looked at, most of this was built between 2001 and 2020. $1.88 billion was constructed during the boom period, with this figure being tabulated after a decrease of 13.5%. Even after a giant reduction of 19%, those built between 1981 and 2000 were still valued at $1.11 billion. New construction managed to shave 9.4% from its value, despite a huge growth spike that was assessed in 2025. While a 16% overall reduction was impressive, clients of O’Connor improved upon the county number by landing a slice of 25.8% from the combined value. Our customers ended up reducing their fair market value by around $141.51 million.

FBCAD uses a wider range of categories for retail spaces compared to apartments or offices. The largest block by far was neighborhood shopping centers with $2.27 billion in combined value, which was achieved after tax protests had netted a reduction of 17.2%. The ubiquitous strip center was No. 2 with $1.8 billion after a small reduction of 4.1%, while community shopping centers were in the third slot with $657.12 million after a drop of 13.1%. Single-occupancy stores and regional shopping centers were much smaller than the rest but still got great reductions of 10.5% and 17.6% respectively.

Warehouse Owners That Joined O’Connor Saved Nearly Four Times More

While not flashy, warehouses can always be depended on. After a concerted appeal effort, the overall worth of warehouses was cut by 7.8%, resulting in a total of $2.02 billion. As with everything else, the majority of value was created by properties constructed between 2001 and 2020. In this case, 64.9% of it. After a reduction of 7.2%, this main block combined for $1.31 billion. The one wrinkle in the timeframe trend was that new construction in warehouses achieved the No. 2 spot. $356.48 in value was attributed to these new buildings, which was after a reduction of 10%. The last major timeframe was from 1981 to 2000, which resulted in a combined $302.49 million after a decrease of 8.3%. O’Connor managed to land warehouse owners the biggest percentage difference yet, with our clients seeing a giant slice of 31% from the combined total. This meant that our customers secured an astounding value savings of $15.41 million.

According to FBCAD, warehouses came in three subtypes. The largest, fittingly enough, was mega warehouses. After a reduction of 6%, these totaled $1.39 billion. The No. 2 spot was reserved for mini warehouses, which came in at $576.92 million after a large slice of 12.9%. Generic warehouses were a distant third, and saw a reduction of .9%, which resulted in a total of $49.77 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.